New Delhi, Jan 25 (IANS) Nearly two-thirds of India’s high net-worth individuals (HNIs) and ultra high net-worth individuals (UHNIs) remain confident about the country’s economic future, even as global uncertainties continue to weigh on markets, a report said on Sunday.

According to the Luxury Residential Outlook Survey 2026 by India Sotheby’s International Realty (ISIR), around 67 per cent of wealthy investors are bullish on India’s growth story over the next 12 to 24 months.

The survey reflects steady optimism about the economy, with 72 per cent of respondents expecting India’s GDP growth to stabilise in the 6 to 7 per cent range in FY27.

While this signals a more moderate pace compared to earlier years, it points to a resilient and sustainable growth outlook supported by strong economic fundamentals and rising wealth creation.

Confidence also remains high in the real estate sector, particularly in the luxury housing segment, as per the report.

Most HNIs and UHNIs plan to continue investing in property, though with greater caution and selectivity.

Factors such as declining interest rates, better affordability and strong end-user demand are strengthening real estate’s appeal as a long-term investment option.

The report notes that wealthy investors expect real estate to deliver healthy returns, with nearly 67 per cent anticipating annualised gains of up to 15 per cent.

Luxury homes are being purchased both for investment and personal use, with 53 per cent of buyers looking at capital appreciation, while 47 per cent are buying for self-occupation.

City-based residential properties continue to be the top choice among affluent buyers. About 31 per cent prioritise primary homes in urban centres, while 30 per cent focus on residential assets purely for investment.

However, the tightening of quality inventory and rising prices have slightly softened interest in second homes over the past year.

Among those still considering second-home purchases, farmhouses near city outskirts are the most popular, preferred by 46 per cent of respondents.

Hill and mountain destinations follow, attracting 33 per cent of wealthy buyers seeking leisure properties.

Last year witnessed record sales by listed developers and several high-value property deals across markets such as Mumbai, Delhi-NCR, Goa and Alibaug.

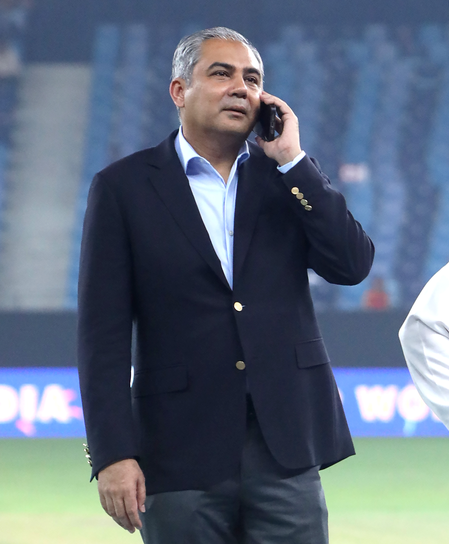

“The year 2026 opened on a note of quiet confidence after a defining year for India’s luxury real estate market,” Amit Goyal, Managing Director of India Sotheby’s International Realty, said.

Goyal added that for these buyers, real estate offers stability along with lifestyle value and long-term wealth preservation, making quality-driven luxury homes increasingly attractive.

Ashwin Chadha, CEO of India Sotheby’s International Realty, said that India’s economic growth and wealth creation are moving together, driving a structural demand for premium residential assets.

–IANS

pk