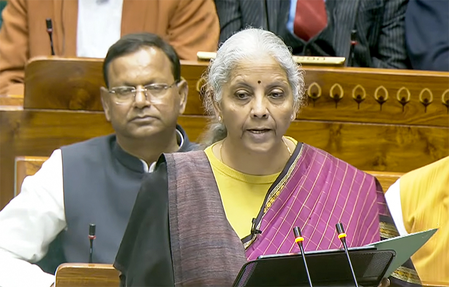

New Delhi, Feb 1 (IANS) Finance Minister Nirmala Sitharaman on Sunday announced a sharp hike in the Securities Transaction Tax (STT) on futures and options while presenting the Union Budget 2026-27 in Parliament.

The move marks a significant increase in transaction costs for traders in the derivatives segment.

The STT on futures has been raised to 0.05 per cent from the earlier 0.02 per cent, amounting to a 150 per cent hike.

In the case of options, the tax has been increased to 0.15 per cent from 0.10 per cent, a rise of 50 per cent.

“This is a meaningful jump, not a marginal tweak, and it is likely to have a direct dampening effect on F&O volumes, particularly among high-frequency traders, proprietary desks, and cost-sensitive strategies,” Aakash Shah from Choice Equity Broking said.

“Overall, while the move may support near-term tax collections, it risks reducing liquidity and market depth in the derivatives segment, at a time when regulators are already seeking to balance speculation control with maintaining India’s competitiveness as a global trading destination,” he added.

STT is a tax levied on the value of securities transactions carried out on recognised stock exchanges in India.

It applies to trades in equities, equity mutual funds, and derivatives such as futures and options.

The tax is collected at the time of the transaction, irrespective of whether the investor makes a profit or incurs a loss.

The Securities Transaction Tax was introduced in India on October 1, 2004, with the objective of simplifying tax collection and curbing evasion in equity and derivatives trading.

At the time, it was brought in after the long-term capital gains (LTCG) tax on equities was removed.

However, LTCG tax on listed equities was reintroduced in the Union Budget 2018, while STT continued to remain in force.

In the previous Budget, the government had also raised capital gains taxes, increasing LTCG tax to 12.5 per cent from 10 per cent and short-term capital gains (STCG) tax to 20 per cent from 15 per cent.

–IANS

pk