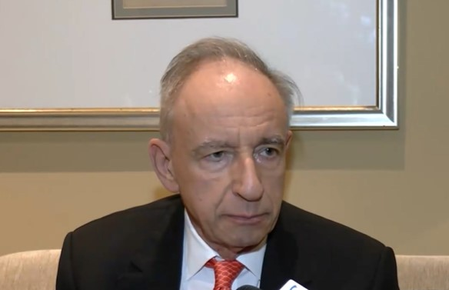

Mumbai, Feb 6 (IANS) RBI Governor Sanjay Malhotra said on Friday that the government’s borrowing programme is on the lower side, which would enable it to raise the required resources at reasonable prices.

Addressing the post-monetary policy press conference, the RBI Governor said there was a need to focus on the net borrowing figure rather than gross borrowings.

“It may not be right to look at the gross borrowing number alone. There are much more redemptions in FY27 so gross borrowing is expected to be higher. Net borrowings, however, are only at Rs 11.73 lakh crore which is only about Rs 20,000 crore more than last year. Given the size of the Budget, one would have expected a much bigger increase,” Malhotra observed.

He said the government will also raise funds through Treasury Bills this year, which should help authorities manage the yield curve better and handle the borrowing programme more efficiently.

“The issuance of treasury bills in the next financial year will help further manage the yield curve better. The budgeted number for the small savings scheme is conservative. The Centre’s borrowing programme is on the lower side and can raise funds at reasonable prices,” he said.

Malhotra further stated that the RBI has made sure there is ample liquidity into the system to ensure transmission of previous repo rate cuts in the economy. The central bank is not looking at making any changes in liquidity management, he added.

He further stated that tax holidays for data centres should help attract fresh investment, signalling confidence that policy incentives can pull long-term capital into digital infrastructure.

The RBI Governor also said that the near and medium term outlook on India’s external account is favourable. He highlighted the string of trade deals over the last one year that is expected to boost exports, draw foreign investments and raise productivity.

“Even after accounting for deficits, India has sufficient foreign exchange reserves to cover its requirements. The reserves are more than twice our short-term external borrowings. “On the external front, the position remains very comfortable,” he said.

Besides, he pointed out that the opening up of the insurance sector to FDI and the investments in India’s private banking space shows confidence in the growth story.

On the macroeconomic picture, the Governor said he is confident India can meet its external sector requirements, adding that the country is at the “same sweet point, or maybe better” on inflation compared with the last policy. Growth also looks stronger than the last time the monetary policy committee met, he added.

–IANS

sps/na