New Delhi, Feb 10 (IANS) The government and the Reserve Bank of India (RBI) have taken various measures to strengthen cooperative banks’ financial health, governance and digital inclusion, along with enhancing deposit security, credit availability and prudent regulation, the Parliament was informed on Tuesday.

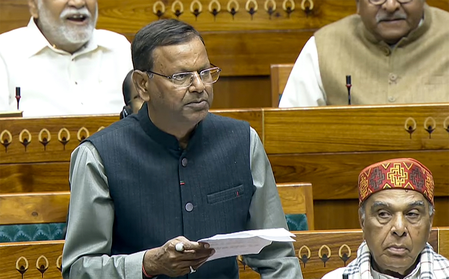

The Central Bank, in consultation with the Centre, announced that loans sanctioned by banks to the National Cooperative Development Corporation (NCDC) from January 19, 2026, for on-lending to cooperative societies are eligible for classification as priority sector lending under the respective categories, said Minister of State for Finance, Pankaj Chaudhary, in the Rajya Sabha.

“These apply to banks other than Regional Rural Banks, Urban Cooperative Banks, Small Finance Banks and Local Area Banks. These loans are for purposes and activities as laid down in the Master Direction on Priority Sector Lending, 2025,” the minister further stated.

While Urban Cooperative Banks (UCBs) have been allowed to open new branches, housing loan limits have been increased from 10 per cent to 25 per cent of their total loans and advances for UCBs,” Chaudhary said.

Moreover, the Banking Regulation Act has been amended to increase the terms of directors of Cooperative Banks from 8 to 10 years amd licensing fee for onboarding of cooperative banks to Aadhar-enabled Payment System (AePS) has been reduced.

“The National Urban Co-operative Finance and Development Corporation Limited (NUCFDC), which is a non-deposit-taking Non-Banking Financial Company (NBFC), has been set up as an Umbrella Organisation for Urban Cooperative Banks to provide Information Technology (IT) infrastructure and operational support,” said the minister.

Notably, ‘Sahakar Sarthi’ has been established to provide technological services to Rural Cooperative Banks, and Rural Cooperative Banks have been included by RBI in the Integrated Ombudsman Scheme.

Also, the Deposit Insurance and Credit Guarantee Corporation (DICGC) ensures various types of deposits up to Rs 5,00,000 per depositor per bank (including principal and interest) for all cooperative banks, the minister said.

–IANS

na/dan